Fast Moving Consumer Goods

Surplus Asset Market Trend Report Summary

By Nusa Tukic, PhD

FMCG Processing Equipment Market Trends

New Equipment Trends and Expansion

Trends

- The FMCG processing equipment market was estimated at USD 64.6 billion in 2023

- Projected to reach USD 84.9 billion by 2028, at a CAGR of 5.6% from 2022 to 2028.

Industry Segments Expanding the Most by Region

Asia Pacific

- Baked Goods Equipment

- Meat and Poultry Equipment

Europe

- Baked Goods Processing and Packaging Equipment

- Beverage Processing and Packaging Equipment

North America

- Baked Goods Equipment

- Non-alcoholic Beverage Processing Equipment

- Dairy-based Beverage Processing Equipment

Source: Business Research Insights (2024), Mordor Intelligence (2024), Grand View Research, 2023, and Markets and Markets (2023)

Used Equipment Trends

While used equipment and machinery market trends are not extensively researched, we can point to some observed trends sourced from a combination of third-party sources and supported by Liquidity Services’ statistics.

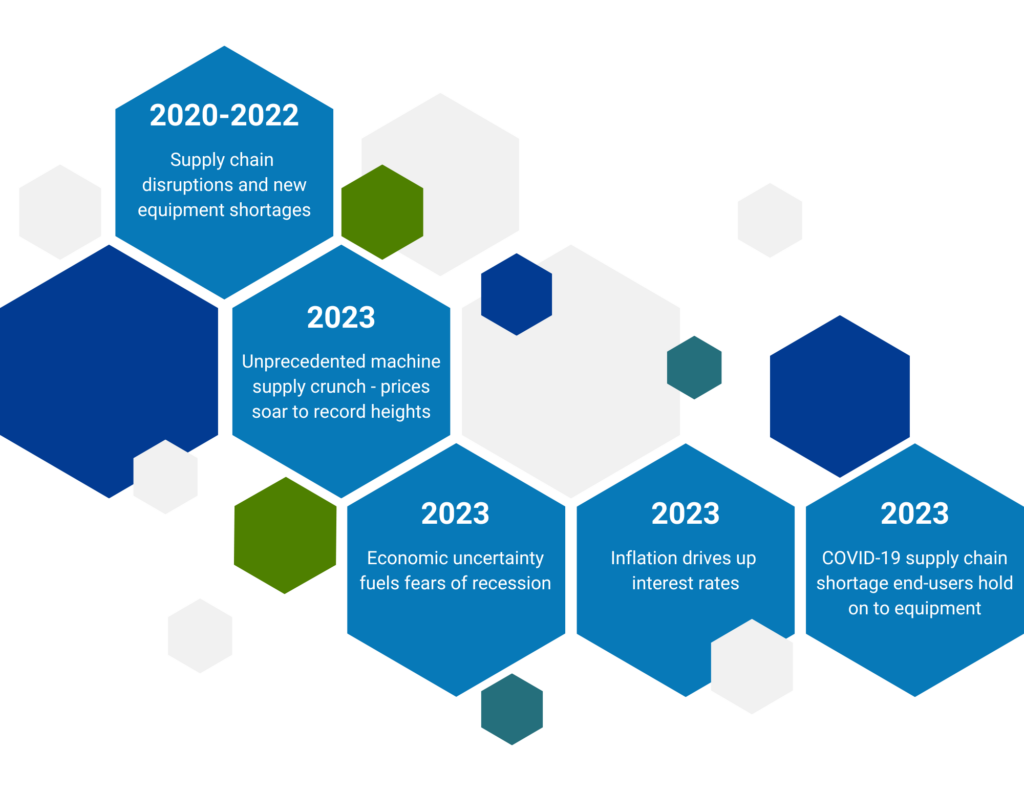

- 2020 – 2022: Supply chain disruptions and new equipment shortages resulting from the COVID-19 pandemic gave rise to a boom in the used machinery market

- Early 2023: The market faced an unprecedented machine supply crunch. Prices for used equipment soared to record highs, and finding used machines was challenging. The causes of this extraordinary situation included:

- Interest Rates: In 2023, inflation drove up interest rates, making equipment loans more expensive.

- Economic Uncertainty: In January 2023, 61% of economists predicted a US recession within 12 months, causing the US Consumer Confidence Index to reach its lowest point in six years.

- COVID-19 Supply Chain Shortage: The pandemic resulted in end-use clients holding onto their equipment longer. This limited the amount of used equipment reaching the market, causing used equipment prices to surge to record levels.

Observed Used Equipment and Machinery Market Trends

Strategies for Surplus Asset Management

With insight from Liquidity Services’ statistics

Make Informed Decisions

- Surplus equipment is a dynamic and fast-moving market.

- Keeping up with current information relating to equipment costs is key.

Avoid Timing the Market

- Sitting on an idle or underutilized machine, hoping for a price uptick can as easily result in a price downturn.

- Capitalize on depreciating assets as soon as possible.

Opportunity Cost

- Your equipment is a business asset, and every surplus item on your balance sheet has an opportunity cost—the cost of the existing asset vs. the return that could be earned on an alternative business investment.

- By holding onto these surplus assets, your organization is locking up capital and may miss opportunities that offer higher returns.

Tax Benefits

- Selling surplus assets before year-end may provide tax advantages.

- By recognizing the loss or gain in the current tax year, businesses can potentially offset profits and reduce tax liability.

Source: Boom and Bucket, 2024; Business Research Insights, 2024

Comments are closed.