Automotive Manufacturing

Surplus Asset Market Trends

By Nusa Tukic, PhD

Surplus Automotive Industry Market Overview

Market Overview, Drivers, and Challenges

Market Overview

- In 2023 and early 2024 the automotive supplier market has seen a significant rebound from the effects of the COVID-19 pandemic.

- Valued at between USD 651.9 and 662.5 Billion in 2022, it is projected to reach USD 1.1 Trillion between 2023 and 2030, growing at a CAGR of 6 – 6.8%.

Key Drivers for Automotive Parts Manufacturing Growth

- The increasing number of electric cars (particularly in the European Union) is driving demand for specialized components like sensors, radar, and lidar.

- The shift towards light commercial, sports, and alternative fuel vehicles spurs innovation in transmission, drivetrain, brake, and steering parts.

- Traditional parts such as engine, electrical, drive, transmission, suspension, and braking components still dominate the market.

- Technological advancements, 3D printing, and e-Commerce platforms are the main trends expected to continue to fuel market growth (Technavio, 2024).

Key Challenges Facing the Automotive Industry*

- Brain Drain: The automotive industry faces a 40% job turnover rate, largely due to poor compensation.

- Aging Workforce: Nearly 25% of manufacturing workers are over 55 and the industry’s struggle to retain quality talent is exacerbated by the retirement of baby boomers.

- Skill Redundancy: Industry 4.0 and electrification have made many labor-intensive workflows obsolete.

- Product Innovation and Compliance: OEMs and suppliers must balance innovation with compliance.

- Customer Preferences: 60% of car buyers are under 45 and expect data-rich, contactless experiences. Manufacturers must reorient their strategies.

- Resource Availability: Manufacturers need to track their resource requirements, manage supply chain risks, and explore circular economy models.

- New Product Demand and Jobs: The shift to electric vehicles will create new jobs, but the U.S. must invest in local production of batteries and drivetrains.

- Agile Operations: OEMs should adopt agile methods to introduce new products and respond to supply chain disruptions.

- Unlocking Data Potential: Accurate data and analytics are crucial for competitive advantage. Automotive ERP software can centralize processes and improve customer engagement and product personalization.

- Building Risk Resilience: The industry must adopt risk management strategies.

*Including Automotive Parts Manufacturing

Source: Technavio. 2024; Cox-Little & Company. 2024

Surplus Automotive Industry Market Position

Compliance and Regulations and Market Position

Compliance and Regulations

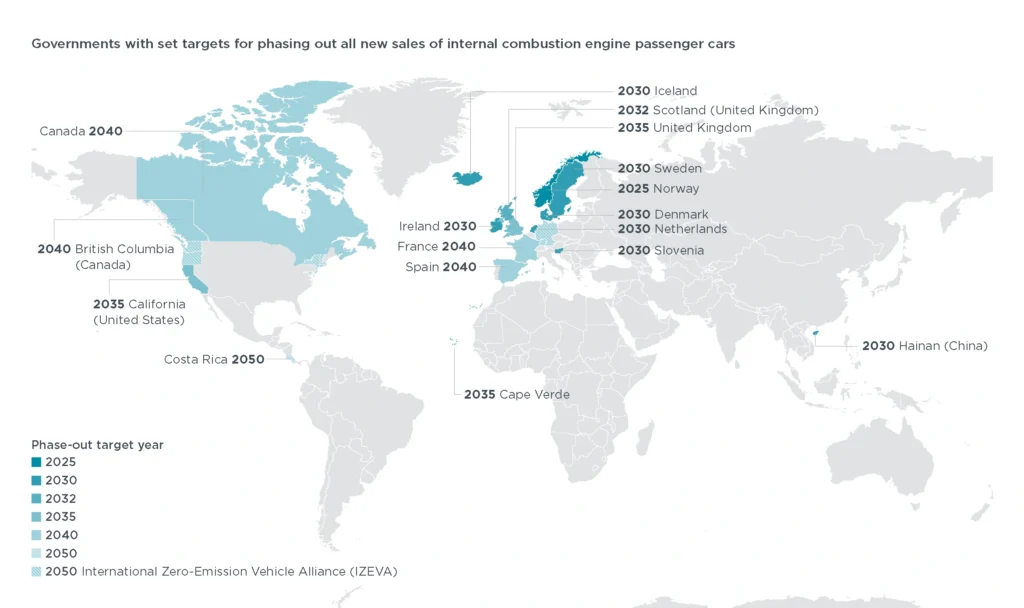

The once-in-a-generation shift the automotive industry faces is also driven by government bodies (national and international) implementing stringent regulations for vehicle emissions, driving manufacturers to continuously develop more sustainable automotive parts. Internationally, a coalition of 23 governments have created the International Zero-Emission Vehicle Alliance (IZEVA), to expand the global ZEV market.

The map below indicates which countries have set targets for phasing out of combustion vehicles and by which year, compared to the overall agreed IZEVA target of 2050.

Countries and Their Target Years for the Phase-out of Combustion Vehicle Sales

Market Position

Considering how capital-intensive the global automotive industry is, it is no surprise that OEMs need to invest in new machines to keep up with innovation trends and remain competitive.

In 2024, US assembly plants are expected to spend $6.18 billion on new equipment, a 3% increase from 2023’s $5.98 billion. The average expenditure on assembly technology will rise to $1,970,582, the highest ever recorded, up from $1,905,175 in 2023, according to the 2023 Capital Equipment Spending Survey. Spending growth is evident, with 38% of surveyed plants having capital budgets of at least $500,000 for 2024, maintaining a trend above 30% for the past six years.

Source: Sprovieri, 2023; American Automotive Policy Council, 2022

Strategies for Surplus Asset Management

Capital Spending and Surplus Assets

Typically, when OEMs invest in capital equipment, auto parts suppliers must also retool and upgrade their machinery. For instance, in 2022, Ford, Stellantis, and GM announced several investments in their existing plants in Missouri and Michigan, prompting their suppliers to follow suit soon after.

According to a 2020 European Commission study that examined the capital spending of 2,500 of the world’s top companies, the automotive industry spent more on capital investment than any other manufacturing industry. The only industry that spent more was oil and gas.

Surplus Asset Management

Asset management protocols are a catalyst for benefitting all industries, including OEMs and automotive parts manufacturers, by reducing acquisition costs. Implementing preventive maintenance and asset life cycle management decreases the need for new equipment and opens avenues for cost savings. In the UK alone, over 40% of capital expenditure for motor vehicle manufacturers between 2014 and 2018 was attributed to new equipment, a figure that can be reduced with effective asset management.

Effective asset management is crucial for monitoring and tracking manufacturing assets. Implementing a robust asset management solution helps businesses efficiently handle asset acquisition, maintenance, operation, renewal, and disposal. This detailed approach enables informed decision-making and enhances financial and operational performance. By implementing asset management, and particularly asset life cycle management protocols, manufacturers can better understand when their machines need to be replaced or disposed of.

Source: Comparesoft, 2021

Liquidity Services has the expertise and tools (AssetZone®) and the platform (AllSurplus) to benefit any manufacturing company as they unlock value in idle and unused machinery, opening the way for capital to be available for future investments. With significant expertise in over 600+ asset categories, Liquidity Services can help OEMs and auto parts manufacturers achieve maximum value from their surplus by facilitating asset redeployment or selling for high recovery.

We Offer Consultative Surplus Asset Management, Valuation, and Sales Solutions

- Program management

- Sales and marketing

- Buyer customer support

- Valuation services

- Warehousing and transportation support

- Asset management

- Compliance and risk mitigation

Comments are closed.