In a recent London Times — Raconteur article, Liquidity Services advised companies to establish effective asset management, disposal, and valuation processes. An accurate asset valuation not only helps businesses to appraise and understand values of their assets, but to raise finance for growth. A credible valuation from a leading provider, such as Liquidity Services, also empowers businesses with data that can drive decision-making.

According to Elaine Shelley, head of UK valuation at Liquidity Services, “The issue is about having a proper understanding of the secondary market for a particular asset.”

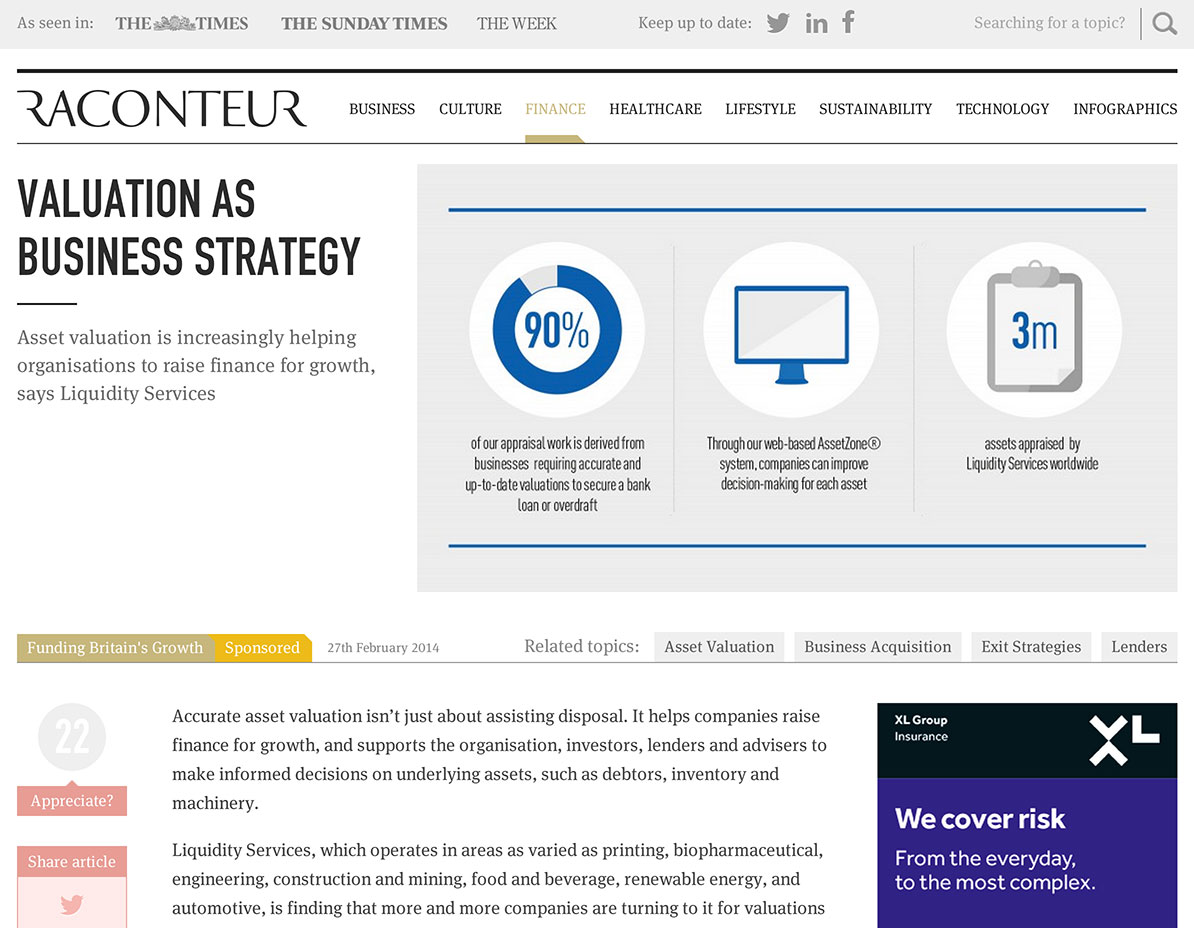

Our valuers are experts in knowing the market value of assets across a range of industries, including: aerospace and defense, energy, biopharmaceutical, healthcare, transportation, construction and mining, automotive, technology, and industrial manufacturing. To date, more than 3 million assets have been appraised by Liquidity Services.

In addition to utilization of valuation services, employing best practices in surplus asset management through the use of online enterprise tools, such as Asset Zone®, a business can obtain greater visibility into their assets. A reputable, web-based platform, such as Asset Zone®, can easily redeploy assets to recover their full value before disposition. This practice also has the added advantage of enhancing and supporting sustainable solutions within the company.

As stated in the article, in addition to valuation and asset management services, our “innovative and powerful online sales channels ensure maximum risk management and achieve the best deals for the end-buyer, often other businesses.”

To learn more, please read the full article at Raconteur and visit our marketplaces to view open auction listings, which include the GoIndustry DoveBid marketplace.

Comments are closed.