Pros and Cons of Auctions

Liquidation Strategies Part I

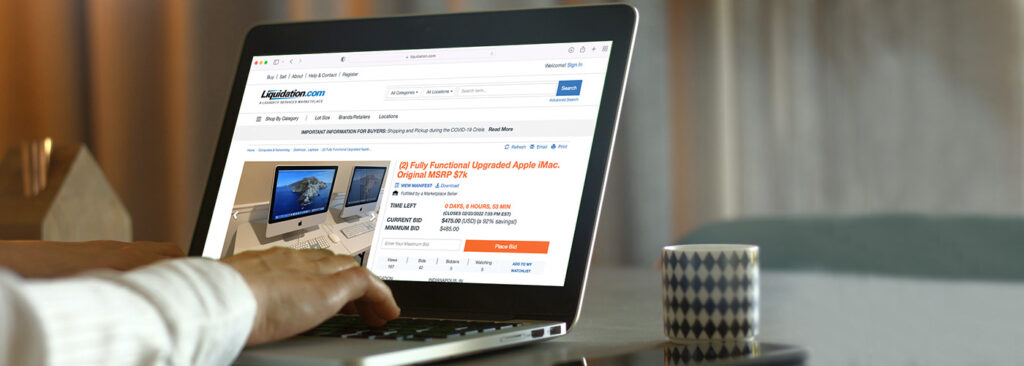

Retailers and manufacturers who have a high volume of returns and excess inventory often resort to using bulk liquidations – selling pallets or truckloads of inventory to liquidators and wholesale buyers. However, in recent years, using online auction marketplaces to sell bulk liquidations has become especially popular.

An auction marketplace can be an excellent way to boost recovery – but it’s not always the best option for every retailer. In this blog, we’ll discuss the pros and cons of auctions: When they’re most effective, which retailers they’re right for and when it makes sense to explore alternative recovery options.

Where Do Auction Marketplaces Shine?

1. Efficiency

Auctions are efficient, particularly when contrasted with private sales. Consider the retailer who negotiates a private sale with multiple prospective buyers. The retailer must share product information with buyers, compare the various offers received from each buyer, then negotiate individually on price and other terms of sale.

Instead, that retailer could list the product on an auction marketplace and get buyers to bid against each other. The online bidding process replaces individual negotiation and saves the retailer time and effort.

2. Competition for Price

In a private sale, individual buyers cannot see how much other buyers are willing to pay for the product. However, in an online auction, bidders can see other competing offers. This often leads to bidding wars, resulting in a sale price that is much higher than the sale price for a private sale.

3. Pricing is Easy

The liquidation price of your excess inventory depends on several factors – product category, condition, lot size, location, etc. If you are new to liquidations or don’t have historical data, determining the accurate price for a private sale can be difficult. If you price your inventory too low, you may leave money on the table. If you price it too high, you may not receive any offers.

Pricing for an auction, however, is relatively easy. You start the auction with a low price and let the online bidding decide the final value of your inventory. Most auctions also have the option of reserve price to protect your downside.

But, There are Downsides

Auction marketplaces don’t always produce the best ROI. When we look at the disadvantages, there are three primary issues to consider: time, unreliable sourcing and volume.

Time

An auction requires at least two to three business days to execute. Even an online auction takes time to gather all the participants in one forum and make them compete against each other. There is also the time needed to collect payments, arrange logistics, etc. The total cycle time from listing the auction to completing the transaction can easily take up to ten days. If you are looking for a quick way to move product out of your warehouse, the auction marketplace may not be your best option.

In addition, you must watch your auction closely, and larger companies who operate their businesses systematically simply don’t have the bandwidth to do that. A small mom-and-pop store, on the other hand, won’t mind paying attention and bidding, and that’s how they’ll win. But for larger sellers, they can waste valuable time with erratic results.

Buyer Preferences

Not all buyers like to participate in auctions. From a buyer’s perspective, auctions take time to bid and win, and their outcome is unpredictable. A bidder could invest valuable time bidding and rebidding … and still not win.

A great deal depends on the type of buyer you are targeting for your liquidations. If you’re selling in pallet quantities and targeting mostly small business buyers, auctions usually are the best option. But if you are selling truckloads with high-value transaction sizes, the buyers you need are large companies. Often, large companies don’t prefer to buy through auctions because of their time commitment and unpredictability.

Volume

If your liquidation volume is steady throughout the year, selling via auctions will work best. However, retailers frequently have seasonal spikes in liquidation volumes, which leads to a mismatch in supply and demand, which results in lower recovery whenever their volume spikes.

Let’s say you’re listing two truckloads a week on a regular cadence, and suddenly after the holidays, that volume jumps from two truckloads to ten. Now, you have injected a significant amount of extra supply into the marketplace – and the same audience of bidders now has a lot more product to bid on. Your pricing is going to drop.

A Better Strategy: Multiple Channels

We know that one size doesn’t fit all. Here’s how we do it at Liquidity Services. We don’t rely solely on auction marketplaces as the primary selling channel. We have multiple selling channels delivering 5+ million buyers. Our B2B auction marketplace, www.liquidation.com, is a leading channel within the secondary market with 20+ years of success. Our direct private sales channel offers negotiated sales with our network of large business buyers. We also have multiple direct to consumer (D2C) selling channels, including secondipity.com and allsurplus.com/deals. Our solutions are flexible to allow you to use just one channel or multiple channels, depending on your needs.

For a few more ideas on improving the efficiency of your reverse logistics operation, and to learn how your colleagues are handling their reverse logistics challenges, download our benchmarking research survey, Recovery & Efficiency: Are Retailers Positioned for Reverse Logistics Success? today.

Comments are closed.