Reverse Logistics:

How to Get Maximum Recovery from Customer Returns

Reverse logistics, particularly a retailer’s strategy for handling customer returns, represents a significant revenue opportunity that continues to garner increased attention as cash-strapped retailers jockey to improve razor-thin margins. Generating the highest recovery is key to success.

Frequently, however, when retailers try to assess their recovery rates, they focus primarily on topline revenue from resale rates garnered through liquidation, including auction returns and/or direct sales to a small slate of existing buyers.

That is a good place to start, but by itself, this strategy overlooks several key areas: handling costs, transportation costs and storage costs.

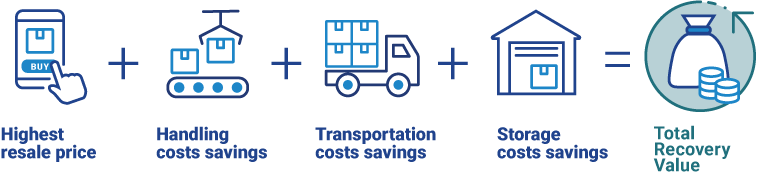

To accurately assess recovery rates, retailers are better served by examining Total Recovery Value: the total of your resale price PLUS savings on handling, transportation, and storage.

If a product is received, triaged, and sorted optimally, refurbished, then sold through the right channels, you will get maximum recovery. Let us take a look at the following graphic.

1. Highest Resale Price

Frequently, we see retailers relying solely on a pre-existing internal slate of B2B buyers to liquidate overstock and returns. That may not be the best strategy to maximize recovery and velocity, for a few reasons. One, it limits the pool of potential buyers. Two, it limits the retailer’s ability to determine optimal recovery via price discovery initiatives. And three, it increases the likelihood of supply chain disruptions.

To help increase recovery, retailers may want to consider adopting the following liquidation strategies instead:

- Leverage partners who can give you access to greater numbers of B2B buyers. A good liquidation partner will offer you several liquidation channels, including online auctions and direct sales to a larger slate of established buyers.

- Consider incorporating D2C (direct to consumer) sales for high-ticket or bulky, heavy items that are difficult to transport. There are millions more consumers than B2B buyers, and they frequently are willing to bid higher for the same items.

- Ensure that your partners and your reverse supply chain have the necessary flexibility to pivot your liquidation strategies in response to changing marketplace conditions.

2. Handling Costs Savings

The fewer the number of touches—the number of times a returned product is handled before reaching its final disposition—the more efficient the operation will be and thus, the higher the recovery. If you are evaluating a third-party partner, they should offer you a plan not only to reduce the number of times your products are touched but also options to execute dispositions locally. Keep in mind that a touch can also be virtual. For example, administrative or customer service support touches count when you figure overall costs and revenue.

A few ideas to cut handling costs:

- Identify and segregate merchandise for liquidation further upstream

- Improve processes for returns dispositioning

- Incorporate virtual sales that do not require picking or staging product

3. Transportation Costs Savings

With rising costs of transportation today, this is a key area to consider. The number of transportation legs has a significant impact on your Total Recovery Value. Transportation legs is defined as the number of times a returned product is transported until it reaches its final disposition and the total mileage. Cut the number of legs and your recovery rate will improve.

You may want to consider these strategies for lowering your transportation costs:

- Perform dispositioning further upstream via store apps or DC sorts

- Lease or build additional DCs or RCs closer to your stores

- Outsource the logistics of managing returns to external vendors

A real-world example: A large wholesale retailer with 400+ US locations was encountering interruptions and failures in its reverse supply chain. Contributing factors included sporadic pick-up of goods, unpredictable freight costs, and diminishing recovery. Additionally, their inefficient solution weighed on the retail and operational teams, creating stress from their store operations, and disrupting their core business efforts.

By customizing a solution that allowed for parcel/LTL shipments to occur on an as-needed basis, we reduced their freight costs by more than $200,000 annually while eliminating legacy shipping issues, which removed the stress from their store operations and allowed them to handle spikes in inventory flow during peak season without disruption.

4. Storage Costs Savings

If you have overstock and returns occupying valuable floor space better suited to forward sales, you will need a short-term storage solution. How and where you store your product has a significant impact on total recovery. A flexible storage solution is mandatory, or product usually sits too long in the DC.

To help cut storage costs, your reverse logistics operation should include strategically located warehouses to reduce freight and cut cross-country travel. Consider also selling direct from your warehouse.

Sometimes, a third-party integrated storage solution makes the most sense.

For example: Liquidity Services slashed storage and transportation costs for one leading international home decorating retailer by leasing a dedicated building for them located near their DC. Then, we provided a pool of trailers to hold their excess inventory. The retailer loads the trailers and furnishes a manifest. We manage all labor and resources and provide drivers and transportation for eight round trips a day, including shuttle service to and from the dock to the building.

This strategy saves them space, labor, time, and hassle. Not only does it eliminate the need for a third-party carrier to schedule pickups, but it also eliminates most overtime labor while freeing up space in their DC for more valuable merchandise. It is an ideal approach for high-volume facilities requiring operational efficiency.

For another retailer, we implemented our award-winning Automated Sell in Place Solution, which allows the retailer to build virtual pallets or multi-pallet auctions and send them to Liquidation.com, our B2B auction marketplace. The actual picking and fulfillment occur at the retailer’s warehouse after the auction closes. All products remain in the rack position until they are dispositioned, which saves warehouse floor space and eliminates unnecessary touches between seller and buyer. In a year, on average, this solution has produced an impressive 20% increase in recovery.

Putting it all together: Total Recovery Value

To get the best value for your returns, we recommend that you start by identifying the critical processes that can affect the entire life cycle of the return. If, for example, a retailer looks only at how many cents on the dollar that their auctions yield, they are likely overlooking other real costs – and corollary savings – that a more holistic view would provide.

If you’re wondering how your colleagues are capturing total recovery value, improving the efficiency of their reverse logistics operation, and solving their reverse logistics challenges, you’ll get answers to these questions and more when you download our benchmarking research survey, Recovery & Efficiency: Are Retailers Positioned for Reverse Logistics Success?

Getting optimal recovery means looking at the full spectrum of reverse logistics — the four Rs: Retrieve, Receive, Repair, and Resell. Limit yourself to incomplete metrics, and you risk overlooking tangible savings. Whether your goal is to improve recovery, maximize velocity, lower return processing costs, or reduce waste and carbon emissions (or all of these), you will improve your overall efficiency and recover many more dollars if you take Total Recovery Value into account. And your COO will thank you.

If you would like to explore other strategies to improve your total recovery, let’s talk. We can design a flexible solution that’s the right fit for your business.

Comments are closed.