In the electronics and R&D engineering industries, product obsolescence is a central part of the business. The need to create new products is essential for staying ahead of competition. Product innovation is often facilitated by process innovation, which means that as demand for new product features and designs grows, certain parts of the production process are altered or removed altogether.

In enterprises with global operations, this can lead to a substantial portion of the asset base becoming obsolete since they need new equipment to manufacture the next generation of products. Obsolete equipment can take up valuable space in storage or on factory floors and prevent businesses from investing in the new machinery they need. For this reason, electronics and R&D engineering companies are turning to the secondary market as a way to cut costs associated with end-of-life disposal and boost their profit margins.

Electronics and R&D Engineering Companies Must Find Profitable, Sustainable Ways to Manage Surplus Assets

Finding a way to rapidly sell or redeploy surplus assets can free up capital, clear valuable storage space, and improve operations by making room for new assets and investments in the business. Liquidity Services helps electronics and R&D engineering companies do just that.

A global semiconductor company had 70 idle vacuum pumps stored in one of its sub fabrication facilities. The pumps were stored in a high-value storage space that the business needed to quickly free up so it could update a key manufacturing plant. With only a month to go before the target start date for the new plant, the company needed to find a buyer for the new pumps before the delays cut into production and profits. Liquidity Services was able to quickly value the pumps and find a buyer who wanted to purchase the lot, enabling the company to dispose of the assets while capturing the highest possible value for them.

When unused component parts or unsold inventory sit in storage, businesses are losing out on a significant source of cash.

The impact that surplus asset management has on a business’s bottom line is clear, but the benefit of finding ways to redeploy or sell underutilized assets goes beyond dollars and cents. With the general trend toward greater sustainability in business, leaders in nearly every industry are looking to manage their underutilized or obsolete assets in ways that benefit the environment. In the past, leftover assets generally ended up in the landfill. But with regulatory and public pressure on enterprises to find sustainable ways to handle waste, solutions that allow for recycling or repurposing unused assets are becoming desirable for businesses with environmental initiatives.

How an Electronics Company Reduced Scrap and Boosted Profits with Liquidity Services

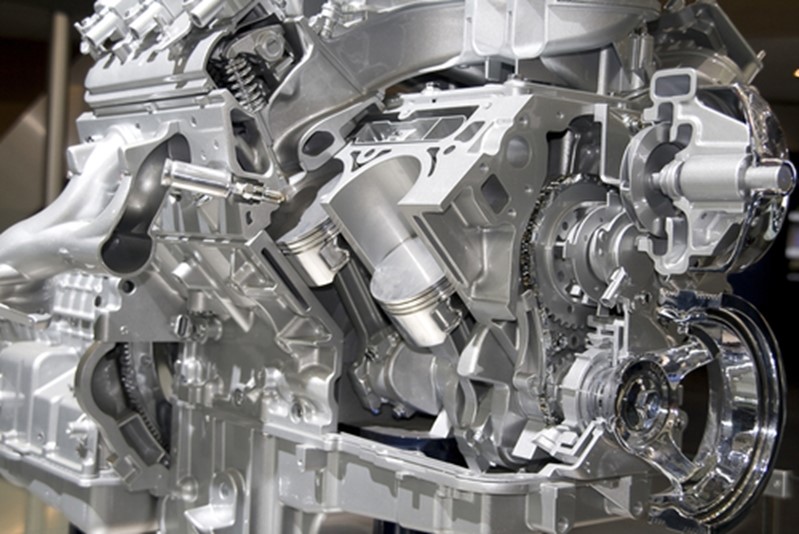

A multinational electronics company headquartered in Europe serves as the world’s largest supplier of automotive components such as brakes, controls, and starter motors. The company has 350 subsidiaries spread out over 60 countries. An abundance of idle surplus assets led the company to seek a vendor to remarket all of its extra components, electronics, plant support, and industrial equipment.

Liquidity Services helped a major automotive electronics company find buyers for its underutilized assets.

As a key partner in this initiative, Liquidity Services provided expert valuation services, inventoried the assets, created auction listings on our online marketplaces, promoted the auctions to our vast base of electronics manufacturing buyers via various marketing strategies, and handled post-sale elements such as payment, removal, and cleanup. This ensured that the company would receive the full value of the extraneous items, improving profits and giving them the capital to reinvest in other areas of the business.

Since 2003, Liquidity Services has facilitated over 100 sales events for the engineering and electronics company, with more than 2,000 different assets sold to the global base of buyers Liquidity Services has access to. Rather than disposing of these assets and taking a financial loss, the company was able to recover nearly $11 million, which it could reinvest in its core business. The proper resale of the assets was also a primary driver in the company’s sustainability efforts since it prevented them from ending up in a landfill.

***

A surplus asset management partner like Liquidity Services helps enterprises accurately value underutilized or end-of-life assets, maximize recovery for these assets via the secondary market, and achieve sustainability goals.

Comments are closed.